M&A Screening as a Service

WHITE PAPER

by Dr. Mai Anh Dao and Prof. Dr. Florian Bauer

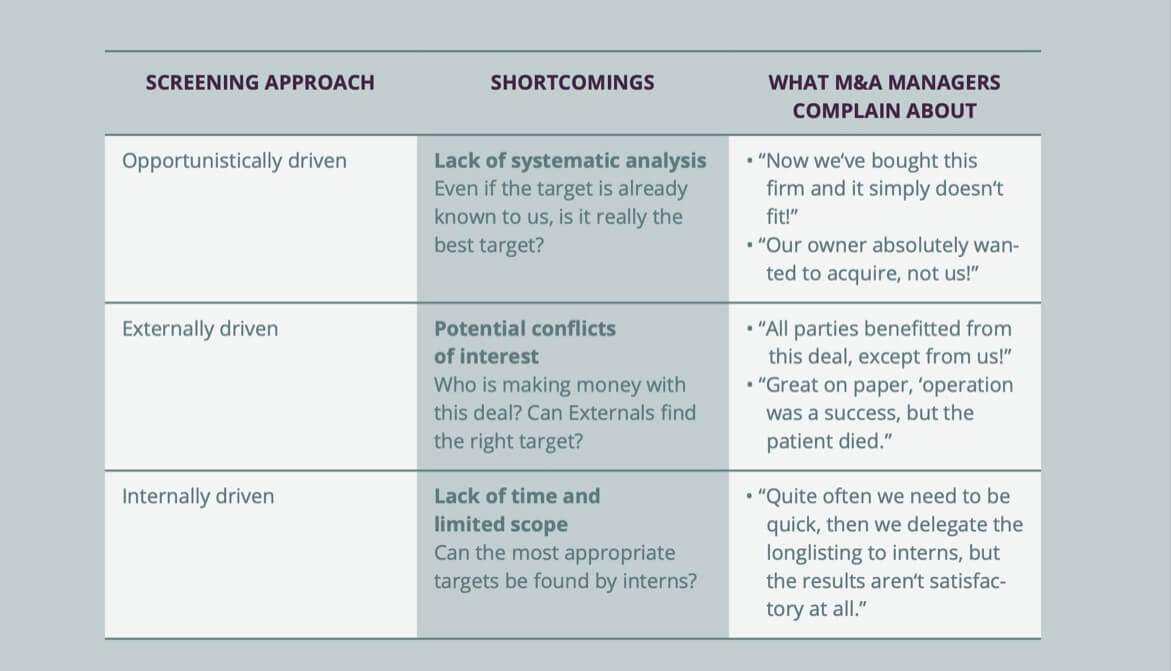

Despite its critical importance in M&A, target screening has received less managerial and scholarly attention than practices of financial valuation and integration. Simply put, target screening matters! Textbook versions of an “ideal” target screening process are usually very different from the reality. What is tought in university involves the systematic, transparent reduction of comprehensive long- lists into shortlists, but management practice provides a different picture. Three most common approaches to screening (i.e., opportunistically driven, externally driven, and internally driven) provide managers with not only specific advantages but also severe inherent disadvantages.

In this white paper, we explain the cognitive biases to be aware of when screening in traditional manners for acquisition targets. M&A teams that understand the mechanisms of these biases can screen more effectively.

Moreover, we outline how the MADiscover technology works based on systematic, comprehensive, and consistent data analysis. We use both a more strategic approach of target screening and AI-based technology for creating actionable shortlists.

M&A Screening is broken. Everyone knows why. Nobody had a cure. Until now.

BACKED-UP WITH RESEARCH

This article is based on a synthesis of the results of ongoing research activities. For more than a decade, the authors have conducted university research on M&A and aimed to ex- tract lessons learned from various interviews with M&A managers about the target screening process.

The founders, Mai Anh Dao and Florian Bauer, view target screening as the central strategic task of corporate development, one in which control, transparency, and traceability are crucial. Financial figures are not, as usual, the sole search criteria but merely serve as selection criteria.

The MADiscover solution digitizes the screening process for enabling M&A managers to identify business opportunities in a strategically driven, transparent and flexible manner. With our AI-based solution, we start where conventional financial KPI and network-driven screening ends.